Indiana paycheck calculator has a flat tax rate, which means you’re charged the same 3.23 per cent rate, regardless of your income amount or the status of your filing. The 92 counties of Indiana in the Hoosier State also levy local taxes. These taxes may bring your total Indiana tax rate for income up to 6.00%, based on the location you reside in.

Your estimated income you are taking home

Where is your money going?

Gross Paycheck

-

-

Taxes

-

-

Federal Taxes

-

-

State Income

-

-

Local Income

-

-

FICA and State Insurance Taxes

-

-

Pre-Tax Deductions

-

-

Post-Tax Deductions

-

-

Take Home Salary

-

-

Indiana Paycheck Calculator to estimate net or “take home” pay for salaried or hourly employees. Simply enter the amount of wages taxes withholdings, the tax withholdings, and any other data below, and our calculator will handle the rest.

How Indiana Paycheck Calculator Works

Employers can withhold federal as well as FICA tax from your pay. Medicare along with Social Security taxes together make the total of FICA taxes. Employers deduct 1.45% in Medicare taxes as well as 6.2% of Social Security taxes per paycheck. Employers also match this amount to provide the total FICA tax contribution of 2.9 per cent in the case of Medicare and 12.4% to Social Security.

Be aware that if you’re self-employed, you have to pay the entire amount yourself. There are a few deductions that can help self-employed employees to recover some of the tax. Also, any earnings over $200 are subject to an 0.9% Medicare surtax.

The IRS takes the federal income tax that is withheld from your earnings and then applies them toward your annual tax on income. What amount of federal tax is paid depends on the information you provide on the W-4 form. Keep in mind that when you start an entirely new job or wish to make any changes then you’ll have been filling out a fresh W-4. Withholding will affect the amount you’ll have to be liable for taxes every pay period.

In recent years In recent years, in recent years, the IRS has made a number of modifications to the W-4. The new form doesn’t allow you to record total allowances any longer. Instead, you’ll have to provide the annual dollar amount for items like income from non-wage sources, tax credits, the total amount of tax-deductible wages, and itemized or other deductibles. The form also has five steps to allow taxpayers to fill in their personal details including dependents, claim dependents, and include any other income or work.

The marital status of your spouse and your number of dependents are elements that impact the amount of tax withheld. Be cautious about underpaying taxes for the entire year. If you do you could be faced with a large cost in April. You may even be penalized in the event that you pay taxes late by more than $1,000.

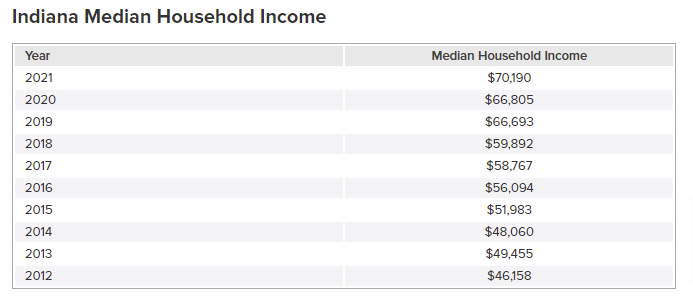

Indiana Median Household Income

Indiana Income Taxes

Indiana has a state-wide tax on income of 3.23 per cent for the year 2021. This means that every one of Indiana residents pays the same proportion of their income as state taxes. Contrary to those who pay under the Federal income tax system the rates in Indiana are not influenced by the income of an individual.

Rates can increase depending on the location. The 92 counties in Indiana collect their own income tax in addition to state taxes and have rates ranging from 0.50% to 2.90%. The counties charge the same tax rate for residents as well as non-residents. The table below lists the tax rates on income for each of the 92 Indiana counties. It is important to note that these rates must be added to the state tax rate of 3.23%.

- Indiana’s income tax rate is a flat 3.23% for all taxpayers, regardless of income.

- The deadline to file Indiana state income taxes for the tax year 2022 is April 18, 2023.

- Indiana offers a variety of tax credits and deductions for individual taxpayers, including a $1,000 credit for each child under 18, a credit for charitable donations, and a credit for contributions to a college savings plan.

- Indiana taxpayers can file their state income tax returns electronically through the Indiana Department of Revenue’s website, or by mail using paper forms.

- If you owe taxes to the state of Indiana, you may be subject to penalties and interest if you do not pay your tax bill on time.

- Indiana also has a county income tax, which varies by county and can range from 0.1% to 3.38% depending on where you live and work.

- Indiana does not tax Social Security benefits or military retirement pay.

- Indiana has a tax amnesty program for taxpayers who owe back taxes. Under this program, taxpayers can pay their delinquent taxes without penalty and with reduced interest.

- Indiana’s standard deduction for the tax year 2022 is $3,000 for single filers and $6,000 for joint filers.

- Indiana also offers a renter’s deduction for individuals who pay rent for their primary residence, up to a maximum of $3,000.

Indiana Sales Tax

In contrast to other states, there aren’t any taxes on sales in Indiana and, therefore, everywhere you go within Indiana, you’ll be charged the same amount of 7 per cent. The tax applies to items and tangible property (like electronics, clothing, and furniture) however it is not applicable to the majority of services. Certain types of food items are tax-free which includes the majority of things you buy from the grocery store. Candy, soft drinks, and other sweets aren’t exempt.

Indiana Hourly Paycheck Calculator

The amount you take home from work is by averaging up to six hourly pay rates you input along with the pertinent federal, state, and local W4 data. This Indiana hourly wage calculator is ideal for people who earn per hour.

Indiana Tax Credits

There are myriad tax credits worth mentioning in Indiana. Taxpayers who donated to an Indiana college or university during the past year could get a credit for less than $100 or half the amount of money donated. This Indiana earned income tax credit may be offered for taxpayers who claim earned income tax credits when filing the income tax form for the federal government.

Then we have it is worth noting that the Automatic Taxpayer Refund (ATR) credit is a tax credit that is granted to all taxpayers in the event of an important surplus to the Indiana state budget. The credit will be granted in 2022, for the tax year 2021 which will be given to all taxpayers who pay $125.

What is the tax rate on sales of 500 dollars in Indiana?

Indiana has a 7 per cent sales tax rate for all of Indiana which does not permit local authorities to collect sales taxes. The applicable rates for sales taxes are identical regardless of where you live located in Indiana. Simplify Indiana sales tax compliance

What is the amount Indiana takes from my salary?

Indiana has a flat tax rate. This means that you’re taxed at a 3.23% rate, regardless of income or tax status. All 92 counties within Indiana’s Hoosier State also have local taxes. Local taxes can increase the entire Indiana taxes on income up to 6.00% based on the location you reside in.

What is the value of 70k, after tax in Indiana?

If you earn $70,000 in a year and live in the state of Indiana, USA, you will be taxed $13,784. This means that your net earnings are $54,216 for the year which is about the equivalent of $4,518/per month.

How much tax is taken out of your Indiana paycheck Calculator?

Indiana paycheck Calculator utilizes an unadjusted tax rate for personal income. All taxpayers are taxed at 3.23%. This makes the calculation of withholding tax relatively simple. It’s as simple as multiplying your employee’s tax-deductible wages by 3.23%. This is the tax amount you pay.