Stay informed about the latest USA state income, sales, and local tax rates for 2023-2024. Our comprehensive guide provides up-to-date information to help you manage your finances and make informed decisions. Explore tax rates by state and locality for the upcoming fiscal year. You can calculate your income taxes by using a Wage estimator.

What is a state income tax?

A state income tax is a tax on the income earned by individuals and businesses within a specific state. It is separate from federal income tax, which is collected by the federal government.

USA State Income, Sales and Local Tax Rates 2024

| State | Tax Range | Other State Taxes | Local Taxes |

|---|---|---|---|

| Alabama | 2% to 5% | Sales tax: 4% | Local sales tax rates vary by county |

| Alaska | No state income tax | No statewide sales tax | Local sales taxes may apply |

| Arizona | 2.59% to 4.5% | Sales tax: 5.6% | Local sales tax rates vary by city |

| Arkansas | 0.9% to 6.6% | Sales tax: 6.5% | Local sales tax rates vary by county |

| California | 1% to 13.3% | Sales tax: 7.25% | Local sales tax rates vary by city |

| Colorado | 4.55% | Sales tax: 2.9% | Local sales tax rates vary by city |

| Connecticut | 3% to 6.99% | Sales tax: 6.35% | Local sales tax rates vary by city |

| Delaware | 2.2% to 6.6% | No sales tax | No local taxes |

| Florida | No state income tax | Sales tax: 6% | Local sales tax rates vary by county |

| Georgia | 1% to 5.75% | Sales tax: 4% | Local sales tax rates vary by county |

| Hawaii | 1.4% to 11% | Sales tax: 4% (general excise tax) | Local surcharge may apply in some areas |

| Idaho | 1.125% to 6.925% | Sales tax: 6% | Local sales tax rates vary by city |

| Illinois | 4.95% | Sales tax: 6.25% | Local sales tax rates vary by city |

| Indiana | 3.23% | Sales tax: 7% | Local sales tax rates vary by county |

| Iowa | 0.33% to 8.53% | Sales tax: 6% | Local option taxes may apply |

| Kansas | 3.1% to 5.7% | Sales tax: 6.5% | Local sales tax rates vary by county |

| Kentucky | 2% to 5% | Sales tax: 6% | Local sales tax rates vary by county |

| Louisiana | 2% to 6% | Sales tax: 4.45% | Local sales tax rates vary by parish |

| Maine | 5.8% | Sales tax: 5.5% | Local option taxes may apply |

| Maryland | 2% to 5.75% | Sales tax: 6% | Local piggyback income tax may apply |

| Massachusetts | 5% | Sales tax: 6.25% | Local option taxes may apply |

| Michigan | 4.25% | Sales tax: 6% | Local option taxes may apply |

| Minnesota | 5.35% to 9.85% | Sales tax: 6.875% | Local sales tax rates vary by county |

| Mississippi | 3% to 5% | Sales tax: 7% | Local sales tax rates vary by city |

| Missouri | 0% to 5.4% | Sales tax: 4.225% | Local sales tax rates vary by county |

| Montana | 1% to 6.9% | No sales tax | No local taxes |

| Nebraska | 2.46% to 6.84% | Sales tax: 5.5% | Local sales tax rates vary by city |

| Nevada | No state income tax | Sales tax: 6.85% | Local sales tax rates vary by county |

| New Hampshire | 5% | No sales tax (has a 9% tax on restaurant meals) | Local option taxes may apply |

| New Jersey | 1.4% to 10.75% | Sales tax: 6.625% | Local option taxes may apply |

| New Mexico | 1.7% to 4.9% | Sales tax: 5.125% | Local sales tax rates vary by county |

| New York | 4% to 8.82% | Sales tax: 4% | Local sales tax rates vary by county |

| North Carolina | 5.25% | Sales tax: 4.75% | Local option taxes may apply |

| North Dakota | 1.1% to 2.9% | Sales tax: 5% | Local sales tax rates vary by city |

| Ohio | 0% to 4.797% | Sales tax: 5.75% | Local sales tax rates vary by county |

| Oklahoma | 0.5% to 5% | Sales tax: 4.5% | Local sales tax rates vary by city |

| Oregon | 4.75% to 9.9% | No sales tax | No local taxes |

| Pennsylvania | 3.07% | Sales tax: 6% | Local sales tax rates vary by county |

| Rhode Island | 3.75% to 5.99% | Sales tax: 7% | Local sales tax rates vary by city/town |

| South Carolina | 0% to 7% | Sales tax: 6% | Local sales tax rates vary by county |

| South Dakota | No state income tax | No statewide sales tax | Local sales taxes may apply |

| Tennessee | No state income tax (although there is a tax on interest and dividends) | Sales tax: 7% (plus local taxes) | Local option taxes may apply |

| Texas | No state income tax | Sales tax: 6.25% | Local sales taxes may apply |

| Utah | 4.95% | Sales tax: 4.85% | Local option taxes may apply |

| Vermont | 3.35% to 8.75% | Sales tax: 6% | Local option taxes may apply |

| Virginia | 2% to 5.75% | Sales tax: 4.3% | Local sales tax rates vary by city/county |

| Washington | No state income tax | Sales tax: 6.5% | Local sales taxes may apply |

| West Virginia | 3% to 6.5% | Sales tax: 6% | Local sales tax rates vary by city/county |

| Wisconsin | 4% to 7.65% | Sales tax: 5% | Local sales tax rates vary by county |

| Wyoming | No state income tax | Sales tax: 4% | Local sales taxes may apply |

State Income Tax Rates 2023-2024

| States with No Income Tax | States with a Flat Income Tax | States with a Graduated-rate Income Tax |

|---|---|---|

| Alaska | Arizona | Alabama |

| Florida | Colorado | Arkansas |

| Nevada | Idaho | California |

| South Dakota | Illinois | Connecticut |

| Tennessee | Indiana | Delaware |

| Texas | Kentucky | Georgia |

| Wyoming | Michigan | Hawaii |

| Mississippi | Iowa | |

| New Hampshire* | Kansas | |

| North Carolina | Louisiana | |

| Pennsylvania | Maine | |

| Utah | Maryland | |

| Washington** | Massachusetts | |

| Minnesota | ||

| Missouri | ||

| Montana | ||

| Nebraska | ||

| New Jersey | ||

| New Mexico | ||

| New York | ||

| North Dakota | ||

| Ohio | ||

| Oklahoma | ||

| Oregon | ||

| Rhode Island | ||

| South Carolina | ||

| Vermont | ||

| Virginia | ||

| West Virginia | ||

| Wisconsin | ||

| District of Columbia |

State Income Tax Rates List

State income tax rates vary by state, and some states do not have an income tax. Here is a list of the current state income tax rates for each state:

- Alabama: 2% to 5%

- Alaska: No state income tax

- Arizona: 2.59% to 4.5%

- Arkansas: 0.9% to 6.6%

- California: 1% to 13.3%

- Colorado: 4.55%

- Connecticut: 3% to 6.99%

- Delaware: 2.2% to 6.6%

- Florida: No state income tax

- Georgia: 1% to 5.75%

- Hawaii: 1.4% to 11%

- Idaho: 1.125% to 6.925%

- Illinois: 4.95%

- Indiana: 3.23%

- Iowa: 0.33% to 8.53%

- Kansas: 3.1% to 5.7%

- Kentucky: 2% to 5%

- Louisiana: 2% to 6%

- Maine: 5.8%

- Maryland: 2% to 5.75%

- Massachusetts: 5%

- Michigan: 4.25%

- Minnesota: 5.35% to 9.85%

- Mississippi: 3% to 5%

- Missouri: 0% to 5.4%

- Montana: 1% to 6.9%

- Nebraska: 2.46% to 6.84%

- Nevada: No state income tax

- New Hampshire: 5%

- New Jersey: 1.4% to 10.75%

- New Mexico: 1.7% to 4.9%

- New York: 4% to 8.82%

- North Carolina: 5.25%

- North Dakota: 1.1% to 2.9% Ohio: 0% to 4.797%

- Oklahoma: 0.5% to 5%

- Oregon: 4.75% to 9.9%

- Pennsylvania: 3.07%

- Rhode Island: 3.75% to 5.99%

- South Carolina: 0% to 7%

- South Dakota: No state income tax

- Tennessee: No state income tax (although there is a tax on interest and dividends)

- Texas: No state income tax Utah: 4.95%

- Vermont: 3.35% to 8.75%

- Virginia: 2% to 5.75%

- Washington: No state income tax

- West Virginia: 3% to 6.5%

- Wisconsin: 4% to 7.65%

- Wyoming: No state income tax

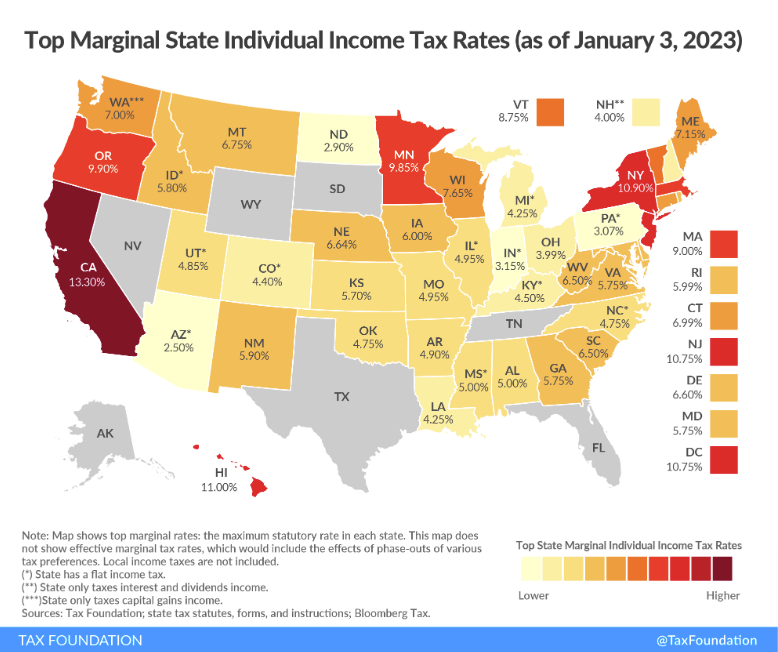

State Income Tax Rates Map

Sources: Tax Foundation

Alabama State Income Tax Rates 2024

Here are the Alabama state income tax rates for the tax year 2024:

| Income Range | Tax Rate |

|---|---|

| $0 – $500 | 2% |

| $500 – $3,000 | $10 + 4% |

| $3,000 – $6,000 | $130 + 5% |

| $6,000 – $9,000 | $380 + 5.5% |

| $9,000 – $12,000 | $655 + 6% |

| $12,000 – $15,000 | $955 + 6.5% |

| $15,000 – $17,500 | $1,280 + 7% |

| $17,500 – $20,000 | $1,655 + 7.5% |

| $20,000+ | $2,030 + 5% |

In Alabama, residents are required to pay state income tax on their taxable income. The state has a progressive income tax system, meaning that the tax rate increases as your income increases. The lowest tax rate is 2%, which applies to the first $500 of taxable income. The highest tax rate is 5%, which applies to taxable income over $20,000. The table above shows the tax rates for various income brackets.

Arizona State Income Tax Rates 2024

Here are the Arizona state income tax rates for the tax year 2024:

| Income Range | Tax Rate |

|---|---|

| $0 – $27,272 | 2.59% |

| $27,272 – $54,545 | $707 + 3.34% of the excess over $27,272 |

| $54,545 – $163,636 | $1,675 + 4.17% of the excess over $54,545 |

| $163,636+ | $6,706 + 4.5% of the excess over $163,636 |

In Arizona, residents are required to pay state income tax on their taxable income. The state has a progressive income tax system, meaning that the tax rate increases as your income increases. The lowest tax rate is 2.59%, which applies to the first $27,272 of taxable income. The highest tax rate is 4.5%, which applies to taxable income over $163,636. The table above shows the tax rates for various income brackets.

Arkansas State Income Tax Rates

Arkansas has a progressive state income tax system with rates ranging from 0.9% to 6.6%. The state has six tax brackets based on income, and taxpayers must file state income tax returns if their income exceeds a certain threshold. Arkansas also allows deductions and exemptions that can reduce taxable income, such as the standard deduction and personal exemptions.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 – $4,499 | 0.9% |

| $4,500 – $8,899 | 2.4% |

| $8,900 – $13,399 | 3.4% |

| $13,400 – $22,199 | 4.4% |

| $22,200 – $37,399 | 5.4% |

| $37,400 and above | 6.6% |

California State Income Tax Rates

California State Income Tax Rates are progressive, meaning the tax rate increases as the income of the taxpayer increases. For the tax year 2023, the tax rates range from 1% to 13.3%, which is one of the highest in the country. Additionally, high-income earners may also be subject to an additional 1% Mental Health Services Tax.

| Taxable Income | Tax Rate |

|---|---|

| Up to $9,330 | 1.00% |

| $9,331 – $49,923 | 2.00% |

| $49,924 – $254,250 | 4.00% |

| $254,251 – $516,500 | 8.00% |

| $516,501 – $1,032,000 | 9.30% |

| $1,032,001 – $2,064,000 | 10.30% |

| $2,064,001 – $5,208,000 | 11.30% |

| Over $5,208,000 | 13.30% |

Please note that the rates above apply to single taxpayers. Married taxpayers filing jointly have different tax brackets.